If you’ve ever needed to transfer money overseas, you know that it can be a tricky process. You want to make sure your money arrives safely and quickly, while minimizing the amount of fees charged.

To help you make the right decision, we’re going to compare two popular money transfer services: Transferwise and Western Union.

Transferwise Vs Western Union 2024

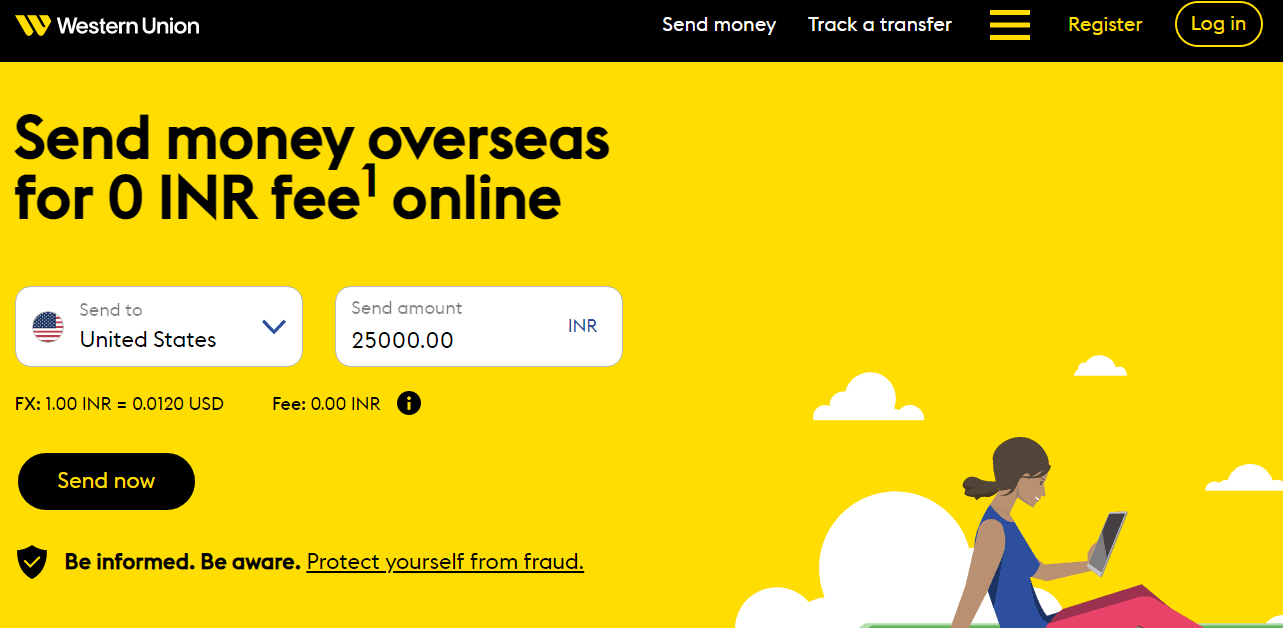

Western Union Overview

WesternUnion is the biggest and most well-known international money transfer company in the world. It is likely the oldest company of its kind that is still in business.

Since 1851, this company has sent money. Even though there are other trading companies, it is known as a society that helps bridge the gap between developed and developing countries and lets thousands of people send money to other countries.

Western Union is based in the United States, but it has offices and agents all over the world. It deals with more currencies in more countries than any other company.

Send money anywhere in the world with just a few clicks and an awesome transfer speed.

Western Union features

- 550,000 offices and branch offices

- 150,000 ATMs and kiosks worldwide

- Runs in more than 130 different currencies

- You get cash, a bank account, a wallet, or a prepaid card.

- Online security centre that connects directly in case of fraud or suspicious activity

- It began in New York in 1851.

- Points-based reward system that leads to money savings

- Great customer service that can be reached by phone, Facebook, Twitter, Pinterest, LinkedIn, or email

- The Western Union Foundation works to help the economy grow and more people get access to money.

- There are regional offices in 19 countries.

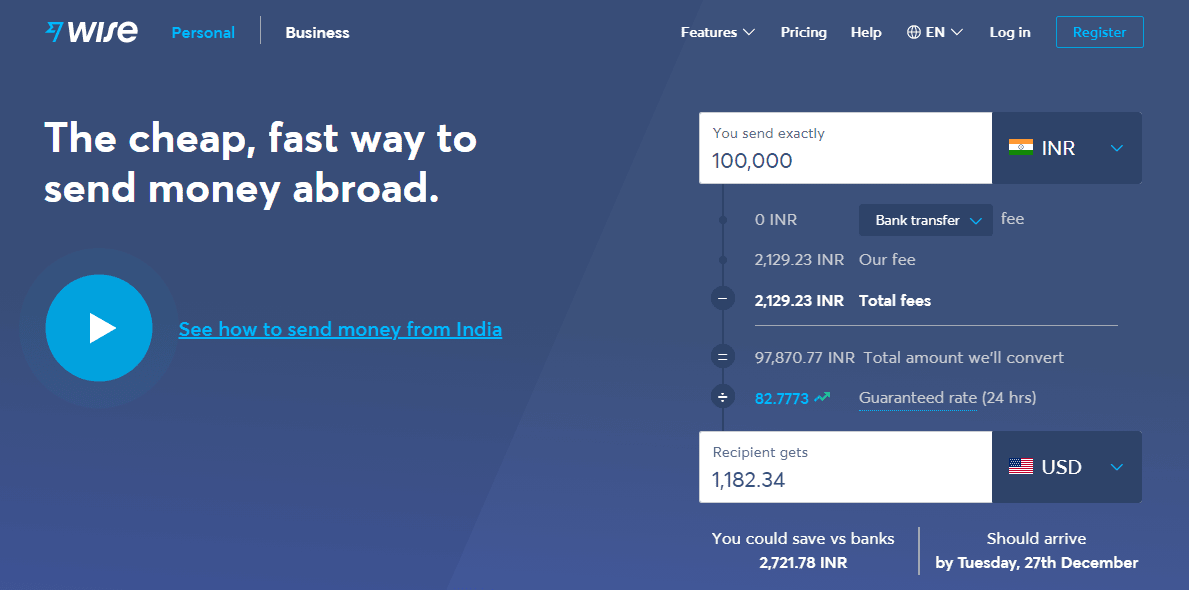

TransferWise Overview

Transferwise is part of the new School of Digital Money Transfer Companies.

It was started in 2011 with the goal of getting rid of the high bank interest rates that come with international payments and to be completely transparent in all parts of your business, including payments, prices, and exchange rates.

Transferwise is one of the most recent examples of a business doing well, and it has won many awards for business success and digital innovation.

The company has gotten a lot of money from outside sources, and its main business is based on a way for peers to send money to each other.

TransferWise features

- Peer-to-peer (P2P) platform

- Nominal transfer fees

- Transfers are made within one to four business days, which is an amazing speed.

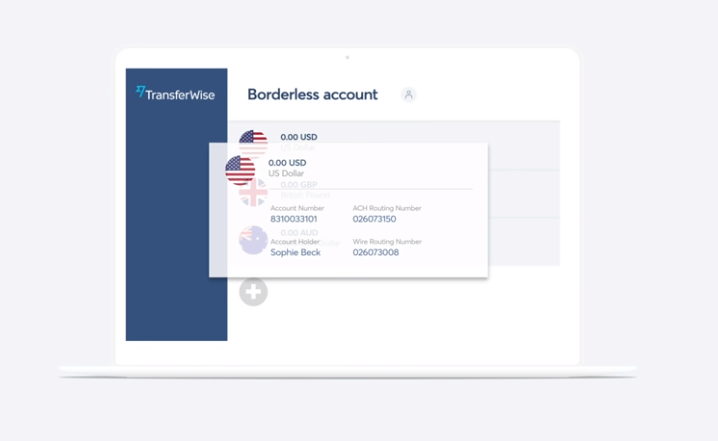

- Accounts with no borders and no one living there

- You can choose from AUD, EUR, GBP, or USD.

- One-time payment or payment over and over?

- Find out about fees and rates before you use an online calculator to send money.

- Using a debit card, Apple Pay, SWIFT transfers, or bank transfers to make a payment

- TransferWise is a feature in Facebook Messenger that lets you make secure payments. More than 40,000 people have given it a 5-star rating on Trustpilot.

- Use the average rate that Reuters gives.

- Customer service is also great.

Exchange rate

TransferWise

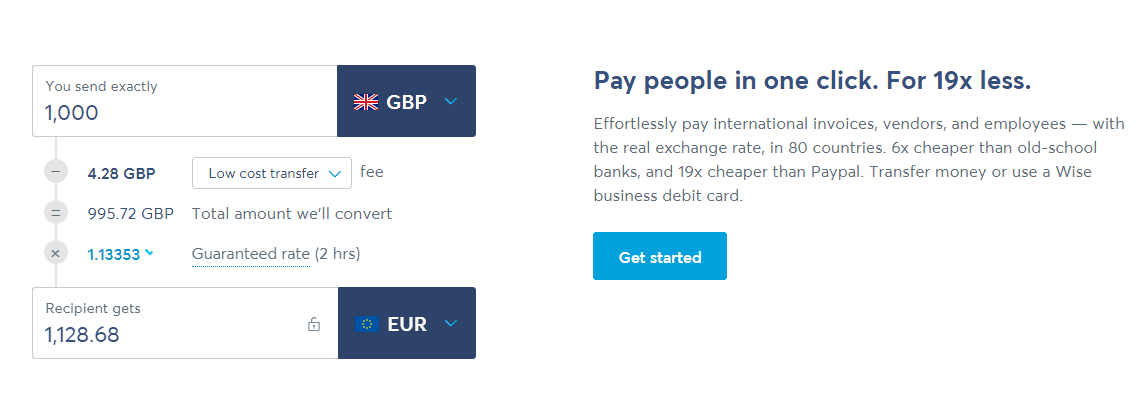

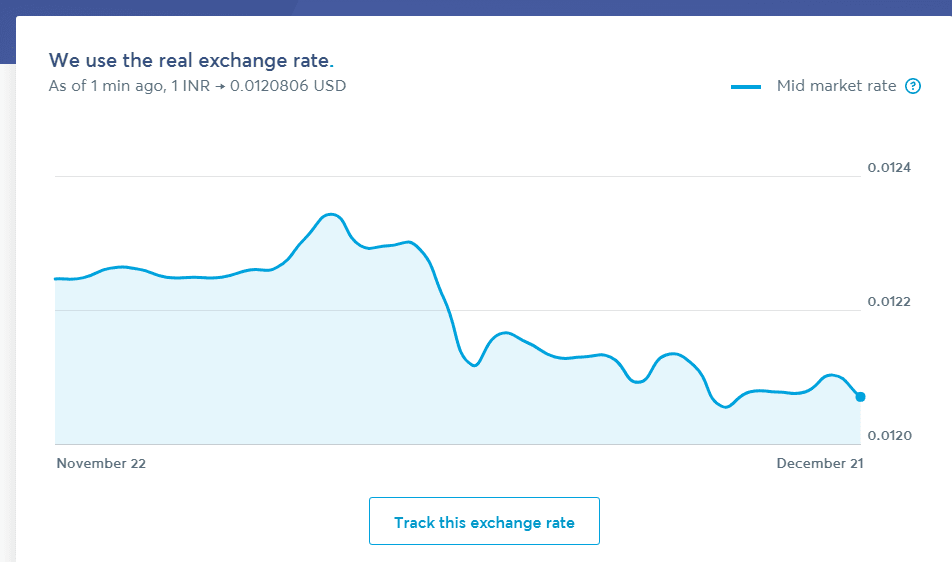

- Check out the current exchange rates by using the calculator on the TransferWise website.

- TransferWise’s prices are close to those of the market.

- Before you make a transfer, find out what the guaranteed exchange rate is.

- You can use TransferWise’s website to keep track of the exchange rates between two currencies.

- To get rate updates, you can sign up for free.

Western Union

- Check current exchange rates with Western Union Price Estimators.

- There may be a difference in exchange rates depending on the method of transfer required for some destinations.

International transfer fees

TransferWise

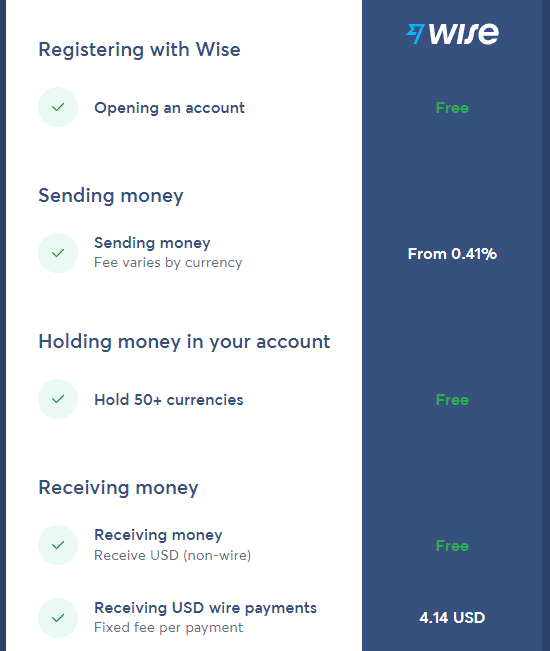

- TransferWise has a website where you can see how they set their prices.

- TransferWise works out a fixed percentage of the amount being sent, which is a very small amount.

- Prices may change based on the country where the item is going.

- There is more information in the TransferWise cost breakdown table.

Western Union

- The cost of your transfer may depend on things like how you send the money, how you pay for it, and where it goes.

- Most of the time, it costs less to send money to a foreign bank account than to a money collection agency.

- Most of the time, the rates for paying with an electronic transfer are lower than those for paying with a debit or credit card.

- Find out how much your bank transfer will cost by using the estimated Western Union rate.

User-friendliness

In this part of the comparison between Western Union and Transferwise, both companies have good ratings, but one of the ways to send money is better than the other. Both companies let you sign up online.

TransferWise

- TransferWise lets you use your website in English, German, Spanish, French, Italian, Hungarian, Polish, Portuguese, Russian, and Japanese.

- TransferWise lets you sign up with your Facebook or Google account, which saves you time and work.

- People, businesses, and suppliers can all get services from the company online.

- It lets you pay with a debit card or credit card and send money electronically.

- TransferWise apps can be used on both Android and iOS devices.

Western Union

- You can go to the Western Union website in Spanish, Italian, French, Russian, German, and Japanese, among other languages.

- You can sign up either as a person or as a business.

- Depending on where you live, there may be different ways to pay. You can pay with cash, debit cards, credit cards, or transfers from your bank account.

- You can set up a transfer with Western Union online, in person, or over the phone.

- Transferring money to accounts and fundraising centres, as well as putting money in mobile wallets, are all ways to get to the destination.

- You can send money to people who are in US prisons through Western Union.

Security

Both TransferWise and Western Union get good marks in this section after being compared to each other.

You don’t have to worry about the security of the information you give online because both companies’ websites use a high level of encryption. Both businesses keep their clients’ money in different bank accounts.

TransferWise

- The Financial Conduct Authority (FCA) is in charge of this company’s business in the UK.

- People who sign in with their Google Account are safer because of a system called “two-factor authentication.”

- Your personal or business TransferWise account is safer now that you can connect to it in two steps. If this feature is turned on, you will need to enter an SMS code that will be sent to your mobile phone.

Western Union

- Various US state regulators. International money transfer company Western Union has been approved.

- The Austrian Financial Markets Authority licenses Western Union International Bank GmbH to provide online money transfer services to UK residents.

Regular foreign payments

No matter if you use TransferWise or Western Union, you can’t plan ahead for transfers to another country.

In addition to OFX, HiFX, TorFX, World First, and Currency Direct, reputable money transfer companies offer similar services.

Vouchers

Promotional offers are offered by both companies to their customers.

- Use your free TransferWise coupon to transfer up to £3000.

- Every qualifying transfer earns you loyalty points through Western Union My WU.

Transferwise vs Western Union: Services Comparison, Exchange Rates and Rates

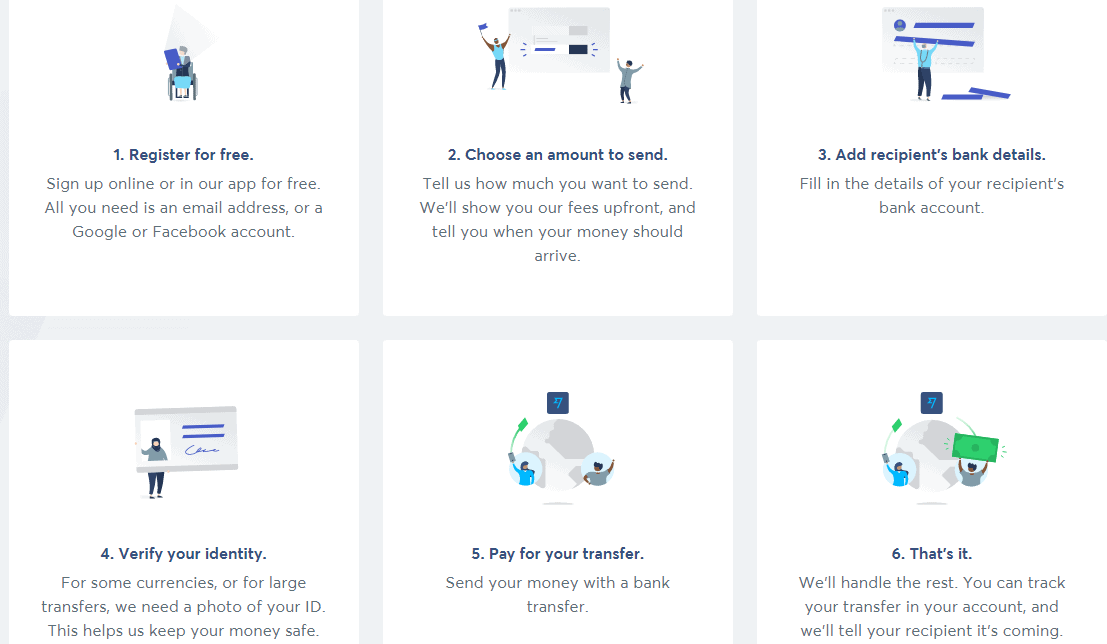

How TransferWise works:

Your bank account, debit card, or credit card is used to pay for transfers. The money is sent straight to the bank account of the person who is getting it. The options change depending on which countries you are sending money from.

For example, if you want to send money from the UK to India, you can use a debit card, a credit card, or your bank account.

But if you send money from Germany to France, you can do it RIGHT AWAY and the other person will get the money right away.

Rates and exchange rates are shown before the transfer. TransferWise will also figure out the fees for you and let you know what local banks charge (which you can not control).

How Western Union works:

Western Union is more than just a way to send money online. Prepaid cards, mobile wallets, and bank accounts are all options for sending and receiving money.

Almost every site accepts debit or credit cards, and some even accept bank transfers (such as INSTANT, Ideal or Trustly ).

Western Union also has a mobile app, which you can find online by searching for “Western Union mobile app.” They also let you pay your bills and send money orders.

Fees

Transferwise figures out a percentage of your total transfer amount. Transfer fees range from 0.6% to 1% (based on currency combination).

Fees vary with Transferwise, but you will not be charged a transaction fee if you pay by bank transfer. Use ACH to pay? The fee is 0.15%, or between 0.3% and 2% if you use a credit or debit card.

It depends. The TransferWise website says that “most banks charge extra fees based on the type of card used and the location of the exhibit.”

The courses are always shown in a clear way. If it is possible to add local bank fees, you will be told.

Fees for Western Union depend on how much money you send, where you want to send it, and how you want to pay.

When you pay for a bank transfer with a credit or debit card and get cash back, that can be the most expensive way to do it. In general, it costs more to pick up cash from an agent than to send money online.

Exchange rate

The average standard rate is what TransferWise uses as its exchange rate. They don’t add a margin to this quota, which is different from what their competitors do.

As with other money transfer services, Western Union figures out the difference between the exchange rate it gives its customers and the average exchange rate on the market.

In our tests, we found that, on average, 20% of Western Union’s income came from the currency ranges. Keep in mind that exchange rates change based on the payment and how it is made.

Exchange rates are sometimes better if you send larger quantities.

Who offers better exchange rates?

The mid market rate is the best way to figure out who has the best exchange rates.

This is the real exchange rate, which is the average of the rates for buying and selling a world currency. This is also the exchange rate that banks and money transfer services use to do business.

Let’s compare the prices Western Union vs TransferWise offer to the average price on the market.

Western Union

In general, Western Union exchange rates are 6% above the average market rate, depending on the country. If you send a large amount abroad, Western Union will make hundreds of dollars. However, it is great for cash pickup.

As an example, let’s use the Euro (EUR):

- At an average market price of 1 USD = 0.96 EUR

- The Western Union exchange rate could be 1 USD = 0.88 EUR.

TransferWise

TransferWise has one of the best exchange rate guarantees, because it uses the same market rate as the average at the time your transfer is made. You will still get the average market price if you send your payment within 24 hours.

In other words, if the average market price is $ 1 = $ 0.82 and you want to send euros to Spain, you will get that price.

FAQs | TransferWise vs Western Union

Does Western Union offer a money-back guarantee?

Our research shows that Western Union does not offer a money-back guarantee at this time. Contact Western Union customer service for more information about its money-back guarantee. You can also check Western Union's homepage to see if their money-back guarantee has changed.

Does TransferWise offer a money-back guarantee?

Yes, Transferwise guarantees your money back. Visit the Customer Service page here to learn more about the TransferWise Money Back Guarantee. You can also check the company's homepage to see if TransferWise has posted more information about its money-back guarantee.

Quick Links:

- Payoneer vs TransferWise

- Apps Like Mistplay For iPhone

- How Much Money Is Billion Views On Youtube?

- How to Make Money Blogging Best Guide

- Best Music Affiliate Programs

- What Is Affiliate Marketing?

- Fresh Store Builder Review

- How Much Money Do Bloggers Make?

- How To Get Paid To Do Nothing

- How to Run the Blogging Business and Make Money

- How to Get Started with Affiliate Marketing

Conclusion: TransferWise vs Western Union 2024

Overall, there are many similarities between Transferwise vs Western Union when it comes to sending money overseas but there are some key differences as well.

For those looking for low fees, convenience, speed and customer service –Transferwise is probably the better option compared to Western Union in 2024 due to its competitive rates and comprehensive online resources that make sending money abroad easy and stress-free.

Of course everyone’s needs differ so it’s important for everyone looking for an international money transfer service to do their own research before deciding which provider best suits their needs!